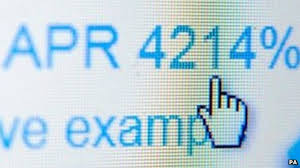

Payday lenders are failing to clean up their act, that's according to Citizens Advice Scotland.

A Financial Conduct Authority investigation has found firms are still failing to treat customers fairly.

However, CAS says complaints about the emergency loan companies are down by 20%.

Citizens Advice Scotland spokesman Fraser Sutherland said: “These latest findings show that we were right to demand action against payday lenders as far back as 2013.

The FCA have revealed that every single payday lender they visited as part of their investigation in the last year had 'serious non-compliance and unfair practices'. This puts to bed the industry's assertion that it was only small rogue traders that were breaking rules.

“The FCA have revealed shocking instances of struggling consumers being completely ignored when they asked for help when they got into arrears. Piles of unsorted paperwork and medical evidence was found at one lender. For these serious unacceptable breaches of regulatory rules we expect the FCA to follow up with robust enforcement fines.

“The one positive we can take from this long list of terrible practice is the fact that the FCA have said that the industry have already put in place changes to ensure these awful practices do not happen again. Indeed, since the FCA took over regulation of this market a year ago we have seen a 20% decrease in the number of complaints to Scottish CABs regarding payday lenders. There are still too many people being caught up in crisis debt, but the tougher regulation does seem to be having some impact. So the FCA must continue in this work and not let up on rogue lenders.

“Meanwhile we urge the public to again hear the message that taking out payday loans can get them into serious financial problems, and that if they need to borrow money they should shop around for safer options, like credit unions.”

Man, 44, seriously injured in hospital after crash between Comrie and Rosyth

Man, 44, seriously injured in hospital after crash between Comrie and Rosyth

John Swinney announces SNP leadership bid

John Swinney announces SNP leadership bid

Closures on A92 from TONIGHT for roadworks

Closures on A92 from TONIGHT for roadworks

11°C

11°C

17°C

17°C